Hang Seng Bank Executives Visit Cheung Kei Group to Deepen Collaboration

2018.06.01

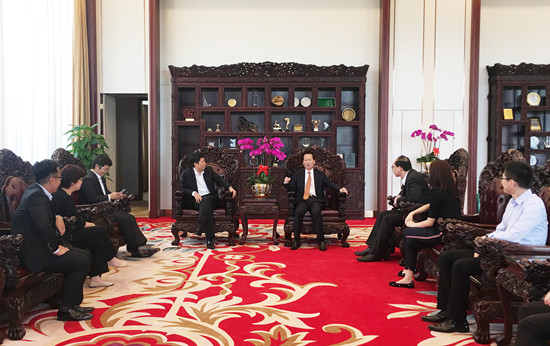

May 29, 2018, Lam Yin Shing, Head of Commercial Banking, Hang Seng Bank, Yeo Chee Leong, Head of Market Risk and Corporate Credit, Hang Seng Bank and their delegation, a total of six members, visited Cheung Kei Group's headquarter in Shenzen and met with Cheung Kei Group Chairman Dr. Chen Hongtian, CPPCC member and Justice of the Peace of Hong Kong, and Chen Pengyu, Vice President of Cheung Kei Group, to reach a consensus on their long-term partnership. Ng Fung Yee, Vice President and Head of Relationship Management, Corporate Banking, Hang Seng Bank; Wong Kei Cheung, Senior Vice President of Relationship Management, Corporate Banking, Hang Seng Bank, Au Sau Kuen, Senior Credit Manager of Corporate Credit Risk Management, Xu Xupeng, Vice Chief Manager of Hang Seng Bank (Shenzhen), Cheng Bo, Chairman Assistantof Cheung Kei Group and representatives of Capital Management Department attended the meeting.

Dr. Chen Hongtian exchanges views with the Head Lam Yin Shing

Dr. Chen Hongtian said that Cheung Kei Group and Hang Seng Bank achieved a great success from their long-term partnership. He also expressed his gratitude to Hang Seng Bank for its full support and hoped that both sides would seek for more collaboration, share resources to create a win-win situation and to set a new example of the partnership between banks and corporations. He believed that Hang Sang Bank would continue to enhance its financial services to help more corporations in Shenzhen and Hong Kong for their mutual development.

The Head Lam Yin Shing said that Hang Seng Bank acknowledged Cheung Kei Group's operational philosophy and strategic development direction. He is confident in its future development. Hang Seng Bank will continue to provide extensive financial services to Cheung Kei Group to facilitate communication between both sides and to deepen their collaboration in overseas investments.

During the meeting, both sides had an in-depth discussion on overseas and domestic investment trends, investment risks control and financial services innovation to lay a solid foundation for their further business collaboration.

- Dr. Chen Hongtian and Other Shenzhen & Hong Kong Entrepreneurs Attending the 3rd Inauguration Ceremony of the Board for the Youth Chawnese Sodality of Shenzhen

- Dr. Chen Hongtian Attended Signing Ceremony for Strategic Cooperation Agreement Between Harmony Club and Wuliangye Group

- Dr. Chen Hongtian & Other Renowned Entrepreneurs Discuss the Development of the Greater Bay Area

- Dr. Chen Hongtian Meeting with Cai Yue, President of Shenzhen Industrial Park Association